|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Mortgage Rates Right Now: What Homebuyers Need to KnowCurrent Trends in Mortgage RatesMortgage rates have seen significant fluctuations in recent months, influenced by various economic factors. Understanding these trends is crucial for potential homebuyers and those looking to refinance their existing loans.

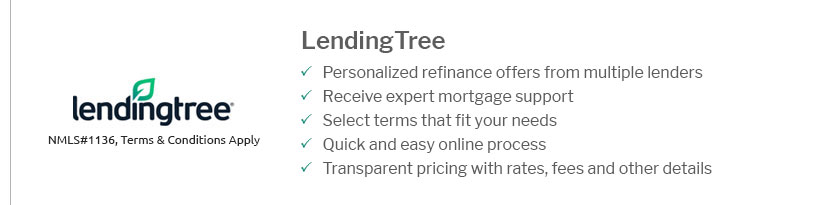

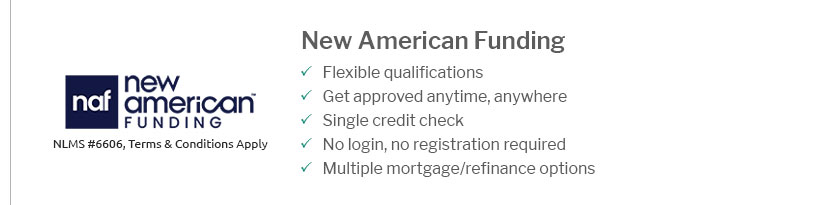

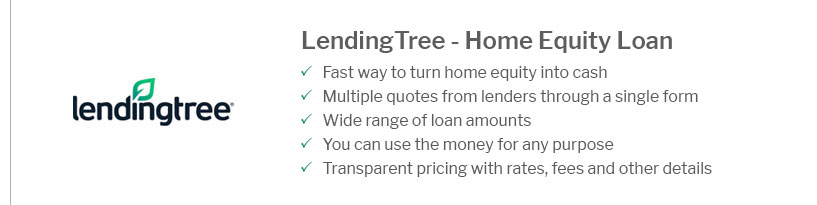

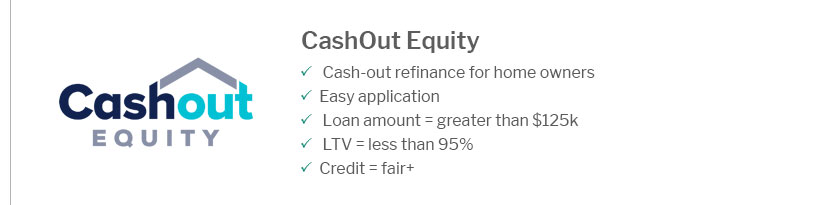

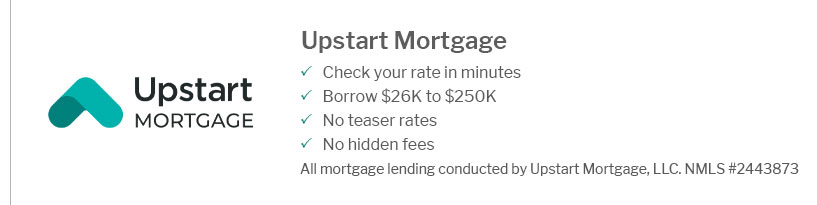

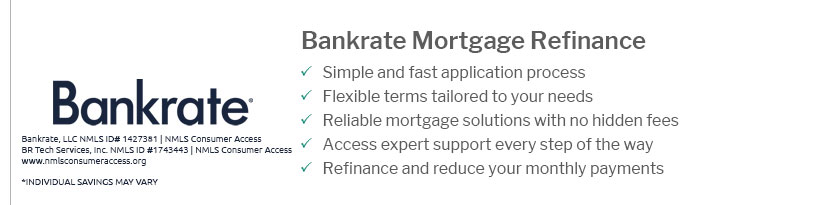

Factors Influencing Mortgage RatesEconomic IndicatorsInflation rates, employment data, and GDP growth are key indicators that affect mortgage rates. Keeping an eye on these can help predict future rate movements. Federal Reserve PoliciesThe Federal Reserve plays a pivotal role in determining the direction of mortgage rates through its monetary policy decisions. Choosing the Right Mortgage LenderSelecting a lender is a critical step in securing a favorable mortgage rate. Consider reviewing a list of top mortgage lenders to make an informed decision. Refinancing OptionsFor those with existing mortgages, refinancing can be a strategic move. It's essential to evaluate whether to refinance and take money out or simply reduce your interest rate and loan term. Benefits of Refinancing

FAQs about Mortgage Rates

ConclusionUnderstanding mortgage rates and the factors that influence them is essential for making informed homebuying and refinancing decisions. By staying informed and exploring different options, you can secure a mortgage that aligns with your financial goals. https://smartasset.com/mortgage/30-yr-fixed-mortgage-rates

Current 30-Year Mortgage Rates ; APR: 6.924%Rate: 6.875%Points: 0.00Rate Lock: 45 daysFees: $1,995 ; Logo. 2024 VA Loans For Veterans. Check Requirements & ... https://www.reddit.com/r/Mortgages/comments/1hqic3j/what_rates_is_everyone_getting_right_now/

5.875%, 15 year fixed. No points, just closed today. San Diego, 25% down and credit score was 785 when lending checked. Upvote https://www.rocketmortgage.com/mortgage-rates/30-year-mortgage-rates

30-Year Mortgage Rates ; 30-year Fixed - 7.125% - 7.449% ; 30-year FHA - 6.375% - 7.261% ; 30-year VA - 6.375% - 6.8% ; 30-year jumbo fixed - 6.125% - 6.329%.

|

|---|